BOEING (BA)·Q4 2025 Earnings Summary

Boeing Q4 2025: $9.6B Asset Sale Masks Recovery Progress as Deliveries Surge 181%

January 27, 2026 · by Fintool AI Agent

Boeing reported Q4 2025 results that beat revenue expectations by 6.9%, with $23.9 billion in sales versus the $22.4 billion consensus . However, the headline GAAP EPS of $10.23 and Core EPS of $9.92 were driven almost entirely by a $9.6 billion gain ($11.83 per share) from selling portions of the Digital Aviation Solutions business . Stripping out the gain, core operating performance remained negative but showed meaningful improvement from the prior year.

The more important story lies in the operational recovery: 160 commercial deliveries (up 181% YoY), positive free cash flow of $375 million (vs. -$4.1 billion a year ago), and a record $682 billion backlog .

Did Boeing Beat Earnings?

*EPS figures include $11.83/share from the Digital Aviation Solutions gain. Excluding this, core EPS would have been approximately -$1.91.

The headline beat is misleading. The $9.6 billion gain from selling Digital Aviation Solutions to Thoma Bravo and Honeywell accounted for 119% of reported core EPS . The underlying business generated a loss, though meaningfully narrower than a year ago. Investors should focus on:

- Revenue beat: Genuine operational improvement with 57% YoY growth

- Positive free cash flow: First positive Q4 FCF since the 737 MAX grounding crisis

- Record backlog: $682 billion provides multi-year visibility

What Changed From Last Quarter?

*EPS improvement driven by one-time $9.6B gain

Key operational improvements:

- 737 production rate increased to 42 per month, receiving FAA approval during the quarter

- 787 production transitioning to 8 per month from 7 per month

- Spirit AeroSystems acquisition closed in December, bringing the fuselage supplier in-house

- 777-9 certification progressed with Type Inspection Authorization Phase 3 flight testing begun

Q3 2025 was burdened by a $4.9 billion charge on the 777X program due to certification delays . Q4 had no such charges, and the Digital Aviation Solutions gain more than offset underlying losses.

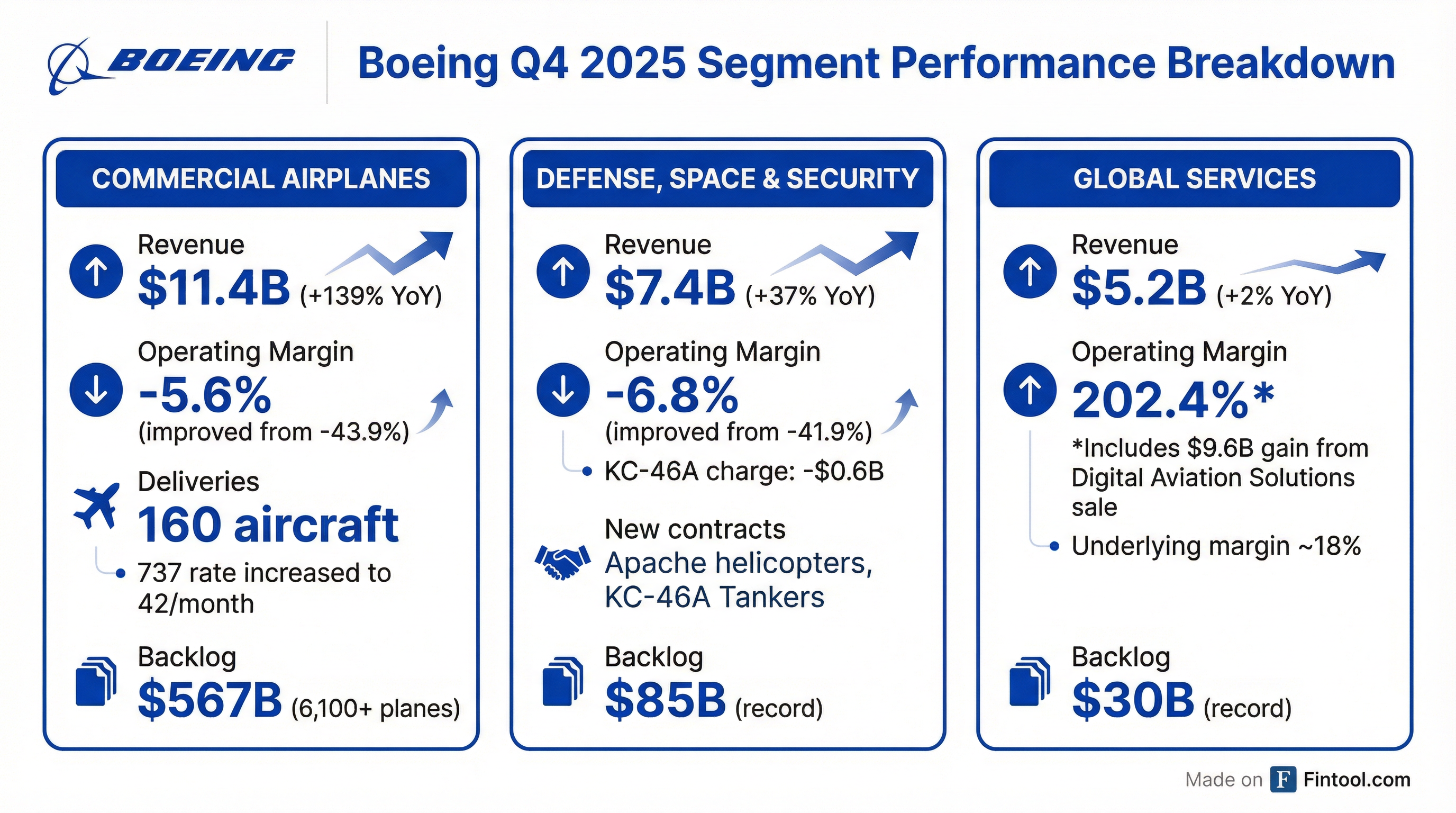

How Did Each Segment Perform?

Commercial Airplanes

Key highlights:

- 737 deliveries: 117 units (up from 36 in Q4 2024)

- 787 deliveries: 27 units (up from 15)

- Net orders in quarter: 336 aircraft, including 105 737-10s for Alaska Airlines and 65 777-9s for Emirates

- Backlog: $567 billion with 6,100+ aircraft

Margin improvement reflects higher volume and better production efficiency, though Spirit AeroSystems integration costs remain a headwind .

Defense, Space & Security

Key highlights:

- Continued KC-46A program losses of $0.6 billion in the quarter

- Won contract for 15 KC-46A Tankers and 96 AH-64E Apache helicopters

- Delivered first operational T-7A Red Hawk trainer

- Backlog grew to record $85 billion (26% international)

Global Services

*Includes $9.6 billion gain from Digital Aviation Solutions sale

Underlying margin (excluding the gain) was approximately 17-18%, consistent with historical performance . The segment secured record annual orders of $28 billion and ended with a record $30 billion backlog.

How Did the Stock React?

Boeing shares surged 4.4% on earnings day, closing at $253.19 after opening at $242.50 and hitting an intraday 52-week high of $254.35. The stock touched its highest level since February 2024, reflecting investor optimism on the production recovery and 2026 free cash flow guidance.

Pre-earnings: Boeing closed at $248.43 on January 26, 2026, down 1.2% heading into the print . The stock had already rallied ~16% in January 2026 and approximately 41% over the past year as investors priced in the production recovery .

Recent EPS History (Core/Non-GAAP):

*Includes $11.83 one-time gain

Boeing has struggled with estimate beats due to repeated charges from the 777X program, KC-46A overruns, and strike impacts. The turnaround in 2025 deliveries has improved sentiment, but the path to sustainable profitability remains uncertain.

Full Year 2025 in Context

Full-year 2025 marks Boeing's best performance since 2018:

- Highest revenue since 2018

- Highest commercial deliveries since 2018

- First positive annual operating cash flow since 2018

- Record backlog across all three segments

Cash and Liquidity Position

The cash increase was driven by $10.6 billion in proceeds from the Digital Aviation Solutions transaction, partially offset by debt repayment related to the Spirit AeroSystems acquisition . Boeing maintains access to $10 billion in undrawn credit facilities .

What Did Management Say?

"As we start this year, we've set the foundation for our turnaround with stronger performance and record-breaking backlogs across our businesses. We haven't fully turned the corner, but we're making real progress and getting back to the Boeing everyone expects of us."

— Kelly Ortberg, President and CEO

"On an adjusted basis, when you look at BGS this past year, they delivered 6% organic growth, as well as 18%+ margins. We expect that to continue as well and be a contributor to cash flow. So if you're asking me, can we be above $10 billion [FCF], I think the potential of our cash flow supports to be above 10. But first things first, let's get to 10."

— Jay Malave, CFO

Key management themes:

- Stability over speed: Production rate increases will continue at a measured pace, following FAA safety and quality plans

- Spirit integration: In-house fuselage production should improve quality and reduce supply chain risk

- 777X certification: First delivery still expected in 2027, potential engine durability issue being worked with GE

- $10B FCF target: Management called it "very attainable" on the call

- Culture change: Simplified 5,100+ work instruction documents to reduce complexity and improve consistency

What Did Management Guide for 2026?

Cash flow phasing: Q1 2026 expected to be a cash use similar to Q1 2025, first half negative, second half positive and accelerating sequentially .

Path to $10B FCF: Management outlined temporary headwinds totaling $6-7 billion that should normalize over time, including 777X pre-delivery payment timing, customer considerations, excess advances, BDS charge runoff, DOJ payment, and elevated CapEx .

Q&A Highlights

On production rate bottlenecks (Doug Harned, Bernstein):

"The 42 to 47 will stabilize here at 42... We'll have a rate review with the FAA, and then we'll go ahead and increase that rate. Supply chain on that ramp, not a big issue for us right now... But going from 47 then to 52, that will be where we'll have to see improved performance from the supply chain."

— Kelly Ortberg

On Spirit AeroSystems integration:

"I think this is one of the big theses and underwrites why we made the acquisition so that we can guide that ramp and help them move forward. I think if they had continued in a distressed environment, I think that risk would have been significantly higher."

— Kelly Ortberg

On BCA cash margins (Sheila Kahyaoglu, Jefferies):

"Right now, 737 and 787 cash margins are depressed, and that's reflected in our free cash flow. We do assume and expect, and given what's in the backlog, that those will improve over time to support these cash flow types of numbers that we're talking about."

— Jay Malave

On tariff and China risk (Rob Stallard, Vertical Research):

"I think the U.S. administration fully understands the importance of commercial aerospace to the economy. They've been very supportive... We do have about the same number of deliveries this year into China as we had last year. So we got to watch these trade barriers."

— Kelly Ortberg

On making airplane manufacturing profitable (Ron Epstein, Bank of America):

"Building an airplane is not an easy task. There's significant risks, and we'll continue to take the risks. The issue that I think we've got to improve upon is how we manage ourselves through those risks and how we enter into contracts... A new airplane program gives us that opportunity."

— Kelly Ortberg

Key Risks and Concerns

- Underlying profitability still negative: Excluding the $9.6B gain, Boeing generated losses in Q4

- KC-46A program continues to bleed: $565 million charge this quarter for production support and supply chain costs

- 777X engine durability issue: Potential issue identified during inspection, working with GE on root cause; not expected to impact 2027 delivery

- Spirit integration adds ~$1B FCF headwind in 2026: Integration costs and transition complexity

- China delivery risk: Same number of deliveries planned for China in 2026 as 2025; trade barriers remain a watch item

- Debt load: $54.1 billion in debt constrains financial flexibility

- Excess advances and customer considerations: Legacy issues from prior delivery delays will take years to burn down

Forward Catalysts

Analyst Sentiment

Heading into the print, analysts were constructive on Boeing:

- Average price target: $258 (3-4% upside from current levels)

- Bernstein (Douglas Harned): Top pick for 2026, price target raised to $298

- Citi (John Godyn): Buy rating, price target $270

- JP Morgan (Seth Seifman): Overweight, price target $245

Wall Street expects Boeing to return to profitability in 2026 with consensus EPS estimates around $3.00 .

Bottom Line

Boeing's Q4 2025 results were optically strong but driven by a one-time $9.6 billion gain. The real story is the operational recovery: 160 deliveries (+181% YoY), positive free cash flow, 737 production at 42/month, and a record $682 billion backlog. The underlying business remains unprofitable, but the trajectory has improved markedly from the crisis lows of 2024.

The stock's +4.4% post-earnings surge reflects confidence in management's 2026 guidance: $1-3 billion positive free cash flow, ~500 737 deliveries, and continued progress toward the $10 billion FCF target that CFO Malave called "very attainable" .

For investors, the key questions are: (1) Can production ramp to 47+ per month without quality setbacks? (2) Will 777X engine durability issues delay 2027 deliveries? (3) Can Boeing execute the KC-46A repricing in Fall 2026 to stop the bleeding on that program? The next major milestones are 737-10 certification, positive FCF for 2026, and 777-9 first delivery in 2027.

Data sources: Boeing Q4 2025 earnings call transcript, 8-K filed January 27, 2026, company earnings releases, analyst estimates. Values retrieved from S&P Global where noted.